Few other sectors are as cost-conscious as logistics. Companies in this sector are particularly careful when it comes to investing in forklift trucks, automated warehouses, or automated guided vehicle systems. Their multi-stage requests for proposals usually spark a bidding frenzy among suppliers. But is that enough to keep the total costs as low as possible? “No,” says Dirk Matura, Managing Director of Industrial Solutions GmbH at technology manager CHG-MERIDIAN. “Many people forget to include important cost centers in their TCO calculations.” He believes there is potential for cost savings in the double-digit percentage range. We spoke to him in an interview.

Mr. Matura, you say that many companies are not making the most of potential savings. Do they have a blind spot when it comes to TCO?

Not really a blind spot, it is just that they can sometimes lose sight of things. Companies fight over every cent charged in supplier invoices, for example the price of machinery, lease installments, servicing, and IT management costs. But when it comes to internal processes and cost centers – staff, procedures, use of premises, efficiency of machines and fleets, ideal useful life – there is often still room for improvement. It is not unusual for only 50 to 75 percent of costs to be included.

How can this be improved?

Put simply, we can often unlock potential savings for our customers in three areas over the entire lifecycle: defining the right equipment usage cycle, providing the optimum operating concept, and choosing the technology best suited to the logistics processes. All this requires technical, commercial, and industry expertise.

What role does this play in the procurement process?

Let me explain by using a forklift truck as an example. First, there is the usage cycle. On the one hand, we have a forklift truck at a very favorable purchase price. On the other, we have an equivalent vehicle as part of a customized business concept. We could now compare the depreciation charges over ten years with the lease installments, but in doing so would already be forgetting one thing, namely that the costs for spare parts and servicing will increase over the course of ten years. However, if I hand the leased vehicle back at an earlier point in the term and obtain a new one, I not only make this saving but also receive a double-digit percentage share of the amount realized by the lessor through remarketing of the asset. Not forgetting, as well, the downtime associated with assets that are more than six years old.

How can CHG-MERIDIAN help?

The first step is to use the right method when measuring costs. We apply the established methods of the major industrial associations, that is to say TCO concepts that have been developed in partnership with specialists. The second step is to get our customers’ procurement and finance departments and staff with operational responsibility together around the table. We help those in hands-on roles to express processes in monetary terms, and those concerned with finance and administration to look more closely and see the full picture.

So CHG-MERIDIAN is a mediator and advisor?

Among other things. Often it is about providing an external and objective point of view and about adapting outdated paradigms to a rapidly changing and digitalized world. Offering comprehensive advice provides the foundations for, but is only one part of, our company’s success. The other is the implementation, the active management of technology. This is where CHG-MERIDIAN takes responsibility.

What does technology management mean? And to what extent do you take responsibility?

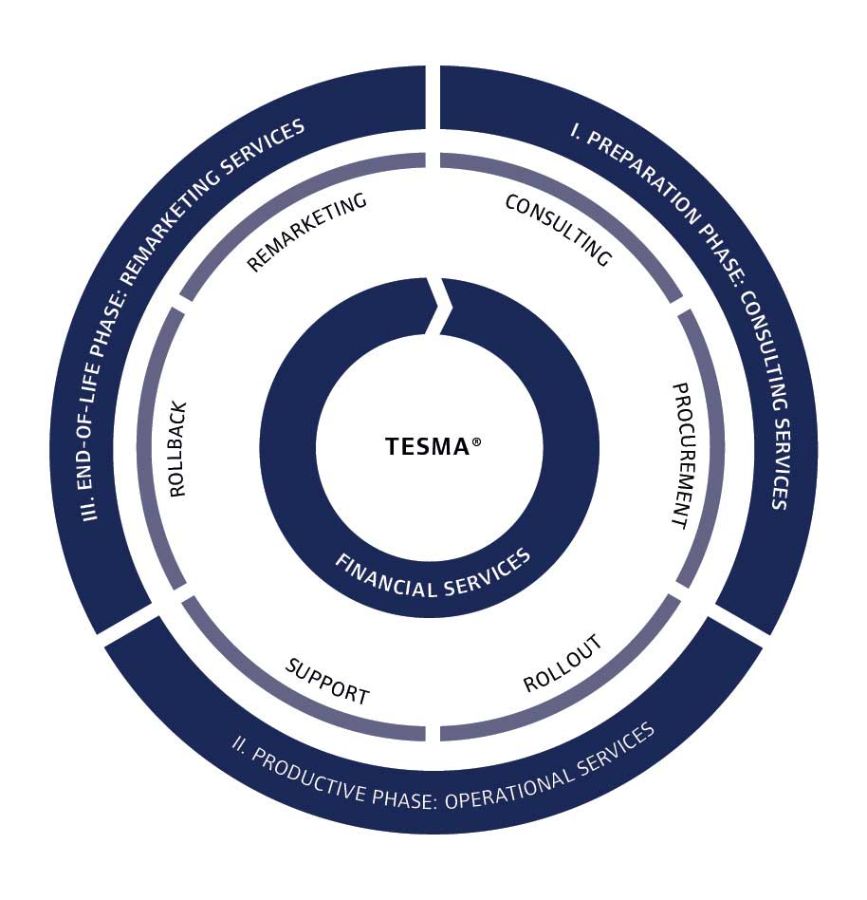

It means that we analyze and optimize our customers’ technology investments throughout the lifecycle, from vendor-neutral procurement strategy to operation and remarketing. We purchase the assets – forklift trucks, robots, or automated guided vehicle systems – and make them available for use by our customers. At the end of the optimum useful life, we take the assets back and remarket them. Part of the estimated resale value is used in advance to lower the customer’s lease installments. The whole package is available to the same standard anywhere in the world thanks to our presence in 28 countries.

Is your approach based on the circular economy model?

It is. We give assets a second life by remarketing them. Our customers no longer have to worry about anything. By the time they have returned the assets, they are once again using the latest efficient equipment.

So sustainability also has a role to play? How does that marry with TCO?

That depends on the customer’s circumstances and the specific application scenario. For example, the more environmentally friendly lithium-ion technology can be cheaper in three-shift operation over the lifecycle than conventional lead-acid batteries. We calculate this as part of our energy strategy and our financing solution. Efficient battery charging concepts are another example. Combined with battery exchange points to reduce the number of batteries needed, they allow our customers to use significantly fewer resources.

Thank you for the interview.

Contact us

Dirk Matura

Sales Director Industrial Solutions GmbH

- CHG-MERIDIAN Industrial Solutions GmbH

- Wilhelm-Wagenfeld-Straße 28

- 80807 München

- +49 89-238856-40

- [email protected]